Playboy Adonis asked me if I was going to write about finances regularly on my blog awhile ago. I don't claim to know that much myself. I really just wanted to start Black Gay Men to think about money more. Think about what you're doing with it. Think about what you want it to do for you. So I decided that occasionally when I hear of something financial I will talk about it. Our community needs to be financially fit so I want to do what I can to support that.

So here are a couple of things to think about:

1. Where are you putting your money????

I'm not going to talk about 401k's, CDs or the Stock Market. I'm just not saavy enough in those subjects to discuss.

I'm talking about where do you put it. What bank are you putting it in. For me I'm trying something new. I created an account with HSBC Direct. It's an online account that earns you 5.05% interest. I won't tell you all the details of how it works you can see that for yourself on their site. I will tell you this though. You can open an account with as little as $1.00. Now I know we all can afford that.

You might remember when I wrote about saving money and how fast it grows if you just forget about it and do it regularly. These types of accounts can help you do just that and add a little more to what you put in. You decide how much you want to put in it. Oh yeah, there are NO FEES for these types of accounts.

Another account like this is ING Direct. You might remember seeing commercials from this company calling themselves the Orange Account. Sometimes this company even gives you money to open an account. I believe it's $75.00. That's free money!

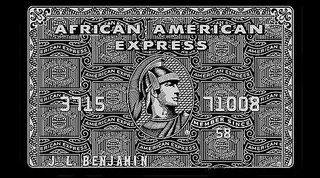

2. How much are you paying in interest on your credit cards??

If you are lucky to have a credit card (or unlucky some may think) then you have to pay interest on these cards. The interest can vary. Credit Cards can mean big financial trouble! I mean big. It so easy to throw that plastic up on the counter and walk out the door. It almost feels like your purchase was free! That is until you get the bill. When you get that bill they have added interest on to what you purchased.

Example: You've see a outfit for $50.00 that you just have to have. Ya didn't need it but ya had to have it! Yall know what I'm talking about. So you purchase it using your Credit Card with the 18% interest. You sign the receipt for $55.13. You forgot about the tax didn't you. Tax in Calif is 8.25%! And you walk out the store feeling good.

Then comes the Credit Card Statement, that's where they tack on the 18% interest charges. Now you do the math. The manner in which finance charges are calculated has always confused me but I know it's money that I'm paying monthly because I didn't pay cash for my purchase.

If you keep paying the minimum payment on your statement, the price of your purchases goes up each month and you end up slowly paying much more for your purchase that you thought was such a good deal.

My advice either pay it off when you get the 1st bill. So you won't be charged the finance charges, or pay more than the minimum so the finance charges will be lower on your next statement.

3. What to do about those high interest cards?

Call the card issuing company and find out your interest rate. If you show a good history of paying your bill call them and see if they will lower your interest rate. If not, ask them how long it will take before you can get it lowered? Then you decide if this is a company that you want to stay with.

If you don't like their answer...Transfer that balance to a Credit Card with better interest. If you are unable to do that. Pay that dayum thing off as soon as possible and then cut it up and close the account.

My last piece of advice on Credit Cards is this. Try not to use them unless it is absolutely necessary or you know you will be paying it off within a very few months. ( I mean like 3 or 4 months no longer)

a Department Store Credit Cards - Do not even get these unless you are just getting credit and trying to establish a credit history. Once you have established a history get rid of these Interest hungry, money grabbing, financial fitness stealing pieces of crap!

And DO NOT let the.... "If you open a card with us you'll save 10% on your purchase today" sucker you in. How the hell much is 10% going to be on your $50.00 purchase. $5.00 but the interest on these cards could be anywhere from 18-25% . All that for one dayum purchase! I think not!

Take control of your money.